Learn

Is Wealth Simple the Best Stock Broker for Canadians?

If you've finally decided to invest in the Canadian stock markets, you'll need a stock broker with the lowest fees. Apart from the costs, there are so many other aspects to consider. Canada offers a conducive environment for investors worldwide due to the low cost of running investments.

The country has lots of investment platforms with attractive features for investors. If you've heard of WealthSimple and wonder if it's worth giving a try, we'll review each of its aspects to let you decide.

WealthSimple is a Canadian online-based financial service provider that oversees more than $4 billion worth of investments. Its popularity has risen to the level of expanding its offerings to the United States and the United Kingdom.

What is WealthSimple?

WealthSimple is a financial advisory and investment service provider with various solutions, including WealthSimple Cash, WealthSimple Trade. WealthSimple Invest, among others. It's the Canadian variant of the US Robinhood app.

If you're interested in trading stocks, the solution you'll be dealing with is the WealthSimple Trade. It's not as great as Robinhood, but it does have attractive commission-free and no-minimum stock trading and ETFs for DIY investors.

WealthSimple automates the investment process to allow anyone to invest their money in a low-cost portfolio that's professionally managed. You don't need to have a six-figure kind of money to invest with the platform.

Clients have access to customized portfolios that match their investment objectives and risk tolerance levels. WealthSimple has increased in popularity due to the incredibly low management fees and stress-free investment opportunities. Having started in 2014, the firm has acquired hundreds of thousands of investors to give it more than $10 billion worth of assets under its management.

WealthSimple Trade and Stocks

WealthSimple Trade stands as a leading online stock broker in Canada that allows clients to buy and sell EFTs and stocks on Canadian and US stock exchanges with zero fees. Typically, transacting any stocks, whether purchase or sale, will cost you something between $5 and $30 for each transaction.

Some exchanges like Virtual Brokers and Questrade also have commission-free stock and EFTs trading. What makes WealthSimple Trade different is that it entirely doesn't charge transaction fees. The other two will eventually charge you up to $10 per transaction when you sell.

If trading with bigger banks, you might end up paying an excess of $30 for each transaction when buying or selling. That's why WealthSimple Trade stands out as a better stock investment option. Those with some expertise in managing their own portfolios will have excellent opportunities to minimize fees and increase their returns. With WealthSimple Trade, you can invest and trade using a non-registered investment account or TFSA.

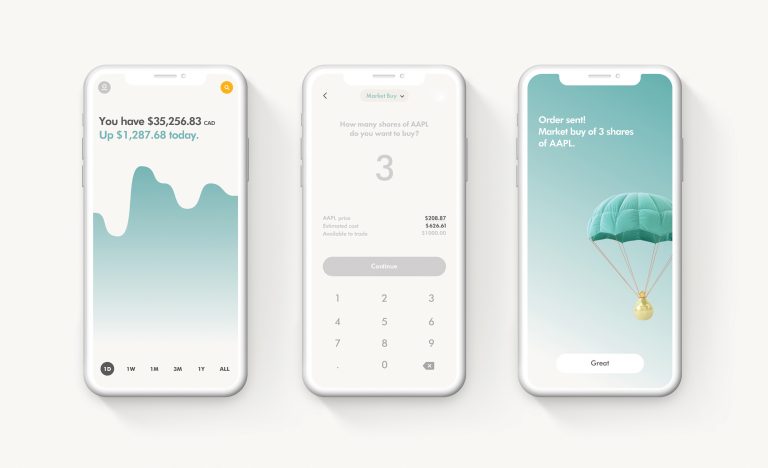

How does WealthSimple Trade work?

WealthSimple is a robo-advisor. It allows investors to save money in fees by investing passively in various exchange-traded funds (EFTs) and stocks. Their app is available for both Android and iOS devices.

Getting started with stock investment is pretty simple. After installing the app on your device, you can choose your account type as non-registered or TFSA. You'll then link your bank account to fund your account then get ready to begin trading.

The app currently has thousands of stocks and EFTs from Canadian and US markets to trade commission-free. What makes it interesting is that you won't be bound to meet account minimums. If you already have a WealthSimple account, you won't need to signup afresh but rather login only.

When you sign up, deposit, and purchase stocks or cryptocurrency of at least $100 within 45 days, you'll receive a cash bonus of $25.

What are WealthSimple Fees on Trading Stocks?

As mentioned earlier, WealthSimple Trade doesn't charge fees for buying or selling stocks and EFTs. Additionally, fund withdrawals, electronic statement requests, and account closing attract zero fees.

What makes it more attractive to budding investors is that inactive accounts don't attract any fees either. That gives you the highest flexibility to trade anytime you want without the fear of accruing high fees should your account go inactive. The only fee charged is $20 for requesting paper statements.

Recently, WeathSimple created a premium service to provide investors with real-time data of the markets. The service also allows investors to make up to a $1,000 deposit instantly at a monthly fee of $3. As such, investors don't need to wait for three days to start investing their funds.

Where Does WealthSimple Get Revenue?

If WealthSimple doesn't charge fees from its stock and EFTs investments, how does it earn revenue? Their revenue comes from the base conversion fees of +1.5% charged for USD trades. Compared to over 2% fees charged by other brokerages on Forex trades, WealthSimple's is competitive.

They also earn from the monthly fees of 3% charged on their premium services.

How Safe is WealthSimple Trade?

Every investor always considers how secure a platform is before entrusting their hard-earned cash to it. WealthSimple Trade belongs to Canadian ShareOwner Investments Inc., a member of the Canadian Investor Protection Fund. As such, investors have protection from insolvency for investments of over $1,000,000.

Reasons to Trade using Wealth Simple

- No fee is charged for both buy and sell trades.

- Canadian stocks and EFTs have zero commission.

- The signup process is simple, with a $25 bonus for investments of at least $100.

- Simple and easy-to-use interface. First-time users will find it easier to navigate through.

- Allows flexibility for investors to set their schedules.

- It has a high level of trustworthiness with asset management of over $10 billion.

- It offers investors' funds protection through the Canadian Investor Protection Fund.

Cons of Trading on Wealth Simple

- Trading US stocks and EFTs have high fees.

- It doesn't allow buying international equities, bonds, and GICs.

- It's limited to trading stocks, EFTs, and some selected cryptocurrencies.

- It does not offer collateral for protection against last-minute price changes.

Is WealthSimple the Best Stock Broker in Canada?

If planning to trade the Canadian stocks and EFTs, WealthSimple is definitely one of the top contenders for the best stock broker in Canadians to use. You'll enjoy zero commission trades for any number of transactions executed.

Commission fees often disadvantage most budding investors. Whether getting started with stock investment or are a seasoned trader, WealthSimple offers an inexpensive way to buy and sell stocks and EFTs.

As a do-it-yourself investor, you'll benefit more from the ability to build your portfolio with the platform. However, you'll need a trading strategy to ensure your trades are within limits and can maintain your cool even as the stock markets experience setbacks.

Want to learn more about trading stocks?

Have you wondered what a day trader is? Understand the strategies behind day trading, and how professionals traders make their living as a day trader.

Day trading has never been more accessible as a Canadian, with no minimum requirements, and the introduction of commission free trades. Learn how to day trade in Canada.

When placing your trades, commissions can cut into your expected returns if you're not diligent about minimizing or eliminating trading fees entirely. Learn how!