Learn

How to Start Day Trading in Canada

Canada presents many opportunities for running investment ideas, owing to the friendly government policies and initiatives. One of the fastest ways to create a lucrative investment scheme is to trade stocks. The good thing with this investment type is that you can build your portfolio from scratch to the level of veterans as long as you practice patience, discipline, and unemotional judgment.

Out of the different types of stock investments, day trading is the quickest way to realize ROI. But you'll need to be a skilled day trader. No one is born an expert; that's why anyone can still learn to attain the level of expertise desired.

Day trading can have exhilarating returns but can also cause massive stress levels and drain your funds. Like any other type of stock investment, it's a risky venture. The risk type is that you should only have funds you're ready to lose. Already made up your mind about day trading in Canada? We'll help you with a guide to get you in the right direction.

Is Day Trading a Profession?

Like it sounds, day trading is investing by buying and selling forex, securities, futures, and other types of stock with returns realized within a day. The practice is highly dependent on the market price fluctuations. Daytraders are very keen on price changes; even the slightest change in price shouldn't go undetected.

The whole idea of day trading is buying low and selling high while beating the deadlines. This type of venture focuses on liquid investments with quick fluctuation rates. You'll be making volume purchases and make a sale as the hopefully rises during the day.

One vital skill you'll need while day trading is the ability to time the market. It's something you cant acquire overnight but requires lots of practice, experience, knowledge, and lots of luck. Most importantly, you'll need the understanding that things may not work your way even with all the expertise.

What markets can you Day Trade?

The Canadian stock markets deal with similar commodities as the US markets. These are the most popular and profitable trading markets today:

Day Trading Stocks in Canada

These can be individual company physical stocks, leveraged and regular Exchange Traded Fund (ETFs), stock options, and futures. Day trading stocks typically offer various opportunities than the traditional buying and holding tactic. If you choose to day trade in the Toronto Stock Exchange Index, your activities will revolve around buying and selling shares from various companies. These include Cenvus Energy, Badger Daylighting, Barrick Gold, and Bank of Montreal, among others.

Day Trading Forex in Canada

Forex trading has a massive volume of opportunities, making it one of the most popular and attractive choices to investors. Trading currencies offer different short-lived opportunities to earn profits from buying and selling international currency pairs.

Forex isn't limited to a central market. You can choose to trade 24 hours, seven days a week, or select only a few hours a day. Trading forex is an excellent start point for beginners or those aspiring to switch to trading from their day jobs.

Day Trading Cryptocurrency in Canada

If you've developed some interest in blockchain technology, crypto trading can be a great investment opportunity for day trading. Some popular cryptocurrencies in Canada and worldwide include Bitcoin, Ethereum, Litcoin, Dogecoin, and Ripple.

Cryptocurrency has gained tremendous popularity, with cities like Toronto and Vancouver leading with businesses that accept payments in Bitcoin. Barriers to making an entry into cryptocurrency day trading are nil. Therefore you can venture in and earn profits.

Day Trading Futures in Canada

Futures are financial contracts that mandate a party to buy an asset at a particular future date regardless of what the price will be at the time. Items dealt with in trading futures can be financial instruments or physical commodities. They're an excellent option for trade speculation and hedging.

Day Trading Binary Options in Canada

Binary options present the modest method with high predictability since the returns and timing on any profitable trade are readily known. They give investors only two possibilities; fixed and nil return.

Binary options are pretty easier to trade due to their precise result. And as such will attract many new budding traders. Better yet, it's crucial to understand how they work before jumping into the trade because there are other notable features worth knowing.

How Much Liquid Capital Do You Need To Day Trade In Canada?

As we detailed earlier, day trading has a high volatility rate, making it one of the riskiest ventures but highly lucrative if done right. You shouldn't invest funds that you aren't ready to lose.

Day traders in the United States will require about $25,000 minimum capital to trade severally in a week. With Canadian markets, you don't have to adhere to such minimums, though some brokers will require you to meet some capital levels amounting to a similar sum.

With day trading, the higher your stake, the higher the returns. For instance, a 1% return for a $5,000 stake will give you $5 only. However, the same percentage on a $500,000 investment will result in a $5,000 profit.

Are You Ready to Start Day Trading in Canada?

Day trading is extensive and intensive. It will require thorough planning and research. The following is a simple guide to give you an idea of what a general day trading strategy might look like for Canadians taking their first step into day trading.

Understand Your Market

Begin with the process of understanding what you're getting yourself into. A general market overview of the market won't do much. Get to comprehend how different global economic events affect the market's volatility and various industries and their effect on trade. You'll also need to learn the skill of anticipating fluctuations.

Establish a Trading Strategy

Every day trader has their preferred style and strategy of trading. You'll have to learn the various tactics available through online courses and references to understand the methodologies, risks, and returns.

Study basic strategies and trades. You may find yourself gaining comfort with the trend following strategy. The vital thing to understand is all styles are speculation-based. You can benefit from free online resources with plenty of insightful stock trends, charts, and financial analysis. You'll also get to understand when to buy and sell, how much to risk, and how you would change your strategy.

Test Strategies on a Demo Account

Online brokerage firms understand that new traders would like to get a feel of the live trading environment. That's why you'll find every broker platform has a demo account.

Demo accounts allow you to learn how the markets work before risking your hard-earned cash. You'll experience a live trading environment by understanding the market, fluctuations, trends, and more. Practice more to develop and perfect your skills without spending any money.

Set Your Trading Goals

Trading with real money can invoke a lot of emotions, whether you win or lose. You'll have to master your trading strategy to eliminate reliance on your own judgment and emotions and rely on facts. Understand the furthest you can go, when to call it quits.

When day trading, it's crucial to know when to start trading, execute a transaction, and such. Failure to sell because you missed the exchange closure can be very costly, especially with the ever-fluctuating market. If you have a day job, you'll need to work with a strategy so that your performance isn't affected.

You wouldn't want to quit before your day trade profits exceed your monthly income from your day job. Set realistic goals; don't invest too much money than you're willing to lose.

Understand Canadian Taxes

While day trading, you'll have to file your taxes accordingly so that you don't end up with a huge bill that swallows all your proceeds. The good thing is that Canada has a straightforward tax rule on trading. Generally, the profits earned from intraday trading activities are not treated as capital gains.

Instead, they're classified as business income. That means that profits are considered as gains and therefore taxed, but losses are deductibles. That gives day traders the benefit of deducting all their losses from an income source to reduce the tax amount owed. It's highly advisable to seek advice from your tax advisor to understand the best way to go about it.

How to Choose a Broker

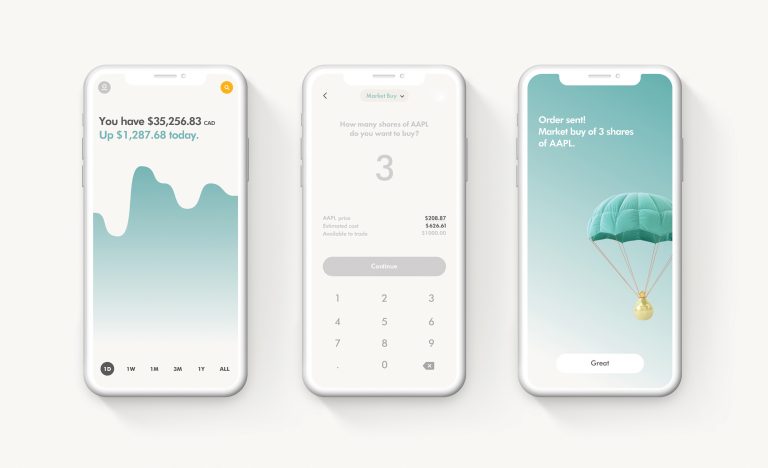

Day trading is conducted via investment platforms. You'll have to review the different platforms offered by brokerage firms before starting your day trades. The brokers are in charge of your trading account and will execute trades on your behalf via their platform.

Whichever trading platform you choose, be sure of their reputation, trading tools, and expertise. Commission-free trading offers an excellent opportunity to start day trading.

Want to learn more about trading stocks?

Have you wondered what a day trader is? Understand the strategies behind day trading, and how professionals traders make their living as a day trader.

When placing your trades, commissions can cut into your expected returns if you're not diligent about minimizing or eliminating trading fees entirely. Learn how!

With more Canadians entering the stock market than ever before, there is a lot of money being spent on unnecessary trading fees and commission. Learn why Wealth Simple is the best broker for Canadians.